The Current State of Student Loans

The author of this guest post is Kristen Hawley. Kristen is a freelance writer with a special interest in student loan debt legislation thanks to borrowing six figures to finance her own education. She blogs here to help others understand exactly what’s happening in the student loan universe and how to best manage their current situations for future success.

Student loans: many of us have (or have had) them; few of us actually like talking about them. There’s a lot of misinformation and misunderstanding about the nuances of loans. Here’s a quick breakdown of the state of student loans today, why I care, and what we should do next.

The Debt

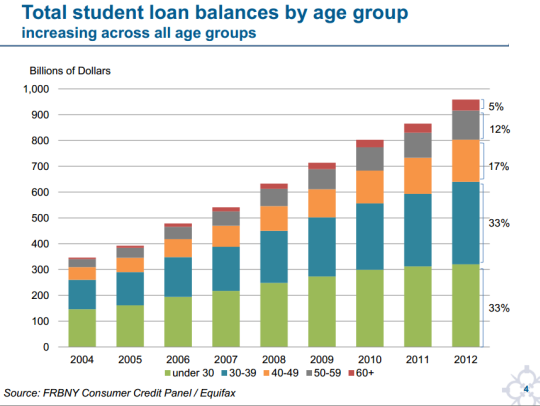

Student loan debt is the trend story du jour, as news outlets cover it extensively, calling it a “crisis,” and likening it to the mortgage bubble in 2008. Positively, we hear that Millennials are the most-educated generation. Negatively, that leaves us saddled with a massive amount of growing debt. The last figures put current collective federal and private student loan debt at just over $1 trillion, with 37 million active borrowers. Average debt owed is around $25,000.

Graph created by the New York Fed

Important things to understand

By now, everyone knows that student debt won’t go away, even in bankruptcy. The Obama administration has taken steps to help make some student loans more manageable; programs like income-sensitive repayment, Pay As You Earn, and eventual dismissal can be (dim) lights at the end of a very long tunnel. But there are plenty of situations where these programs cannot help. Private loans, often those with less-than-favorable repayment terms, aren’t applicable to any of the federal programs. In fact, the federal income-based repayment program (among others) won’t take private student loans into consideration when figuring your income-to-payment ratio.

There are plenty of small nuances like these, quick to confuse former students looking into relief programs and options. It’s a changing landscape, too. Current and proposed bills contain small nuances that affect the situation, and they’re easy to miss. At times, the situation seems to be getting better, slowly. But for the individual student loan borrower, staying well-informed is paramount to success.

Why I care

I’m Kristen, and I took out loans to cover about 80 percent of my undergraduate education at a private university. After maxing out federal loans, I turned to private loans to cover the remaining balance, totaling close to $100,000. Thanks to parents with good credit, I was thankfully able to secure a private loan with fairly reasonable terms (a 20-year repayment plan and reasonable interest rate.)

Despite favorable terms, paying each month post-graduation — even with a full-time job in 2004 before the economy tanked — was a struggle. I spent hours researching my loans, trying to figure out payment options… but mostly trying to figure out how I managed to get myself into this situation in the first place. The worst part: while searching for some sort of camaraderie — or even compassion — I found lots and lots of negativity: commenters telling people (like me) who had borrowed a large sum of money for school that they were irresponsible… or even stupid. Once, a CSR for my private loan company told me I should consider moving home with my parents in order to pay. So much for loans giving me a chance to succeed.

When paying down any type of debt, the first, and often hardest step is admitting how much you owe. Staring at a six-figure amount as a 21-year-old recent graduate is terrifying. Real talk: If I’d thrown my entire salary at my student debt, it would still have taken four-plus years to pay off. It took some time, but I eventually resolved to look at the massive amount I owed as only small pieces, focusing on paying the minimum amount on time each month with a sense of accomplishment.

While I eventually got my own debt under control (still making the monthly payments I’ll make until age 43), I believe the light at the end of the student-debt tunnel will only be made brighter by the shared and open exchange of stories, information, help and understanding. I was shocked by the support I received once I mustered the courage to share my own loan situation — stories from friends and strangers in similar situations feeling similarly hopeless. National legislation is a slow-moving beast, and I don’t have faith that private lenders are going to wise-up about terms they consider less than favorable. Sweeping industry change may not come overnight, but a shift in our attitudes and understanding of the current situation will make those of us facing debt feel a whole lot brighter about the present and future.

The loan payments end up being one of the largest monthly bills facing young people, and they end up being put off through deferments, forbearance, income based repayments (all saving the borrower in the short run) but eventually all that interest has to get paid…..and that is the problem. We don’t all make six figure incomes after we get educated. We cannot all afford (without living at home with mom and dad) or taking a roommate, etc. to pay the minimum payment on a balance as high as 100K. Maybe forbearance, etc. is too easy to get, or perhaps some programs to encourage repayment or a discount for paying off any balance in full over 25K at once would be helfpul. I know that over the years my ex had windfalls in the form of bonuses and he never paid his student loan an extra dime and he eventually defaulted after using all his deferments up and being unemployed twice. These loans all need paid back, the soaring costs (inflated) to get a piece of paper to get a remedial job with a lot of loans is not a good combination. Are only the wealthy supposed to get an education? We need more alternatives than a college degree to get employed. Employers want everyone to have a degree, even for the $12/hr jobs. Give me a break! And they keep throwing more classes at the students that are not even geared toward what they will be doing for a profession. With the stakes so high, education needs to change, it just is not worth what is being paid for it, in many instances.