Personal Loans With Bad Credit Demystified

With the way the economy has been going for the past several years its no wonder there are many people out there having financial problems. One of the side effects of losing your job is often missed payments on your home, auto loans, on credit cards and on other revolving debt. In just 2-3 months you could wipe out years of work building your credit score and end up as one of those classified with bad credit. And it doesn’t end there because the bills still have to be paid, but without a good credit score it becomes increasingly difficult to get new credit or to negotiate a decrease in your current rates. How do you escape from the spiraling problem?

Getting personal loans with bad credit is often considered difficult if not impossible, but they can provide a huge boost for those suffering from poor credit scores. And personal loans for people with bad credit can actually work in your favor because as you continue to make payments your credit score continues to rise.

When you submit any loan application, including an application for a personal loan with bad credit, the lender makes a risk determination based on your credit score and your past credit history. Of course if you have a history of repayment problems on loans it becomes increasingly difficult to secure a loan. It’s ironic, because often those with poor credit histories are the ones with the greatest need for bad credit personal loans. Depending on the terms of the loan, getting a loan can help the person continue making payments and might give them enough time to get back on their feet.

When searching lenders for personal loans for bad credit, you should know that there is little difference between getting the loan from a source online, from a traditional bank or credit union. Some people believe that online sources will always have better rates and terms, but this simply isn’t true. Often your own bank will offer you good terms simply because they already have an established relationship with you. The only way to know for sure what company is going to offer you the best terms is to do a detailed search and get offers from 4-5 different companies, both online and offline. Never assume anything when it comes to searching for personal loans, bad credit isn’t the only determining factor so you can find a wide range of offers.

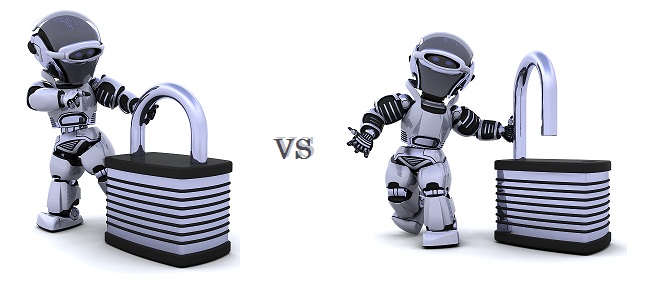

Secured vs Unsecured Loans

When applying for a personal loan for bad credit you have a choice between a secured loan and an unsecured loan. Secured loans are those that are “secured” with some form of collateral. Lenders find these loans to be safer because they are able to sell the secured asset and not lose money from the loan if the lender happens to default. Unsecured loans are those without anything of value backing them and are much riskier for the lender. Those who have equity in a house, own a car or have some other valuable asset will probably want to consider a secured loan since the rate will be much lower and the chances for approval are better.

Another type of unsecured loan is what is known as a payday loan. Payday loans are meant for emergency use and quick repayment and typically they are for amounts less than $2500. These small personal loans for bad credit are often said to have guaranteed approval because the lenders do not perform a credit check. Unless you are in extreme dire straits these types of personal loans are not recommended as the interest rates are exorbitantly high. If you are unable to pay the loan off at the end of the term (anywhere from 1-4 weeks) you can end up owing much more than you borrowed and may never be able to repay the loan because of the increasingly hefty interest charges.

Getting Approved for a Personal Bad Credit Loan

While approval can be difficult for some borrowers there are steps you can take to improve your chances of being approved.

1.Use a secured loan rather than an unsecured loan. Lenders are always more willing to lend with collateral to back up the loan.

2.Get a copy of your credit score before applying so you know exactly where you stand. This will help protect you from lenders who may not read the credit history or could even try to lie about your credit score.

3.Apply with a minimum of 5 lenders who have a good reputation. Research the lenders background and see what others have to say.

4.Negotiate the rates and terms with the lenders. Don’t only focus on the interest rate, but also consider the length of the loan, any fees and the complete terms and conditions of the loan.

5.Search for lenders who advertise guaranteed loan approval.

I know that figuring out how to get a personal loan with bad credit can seem daunting and complicated, but it really is not all that bad. A simple understanding of what lenders are looking for and how to give them peace of mind when lending to you can go a long way. Expect to have to shop around, pay a higher rate than normal and to negotiate for your loan. Don’t take the first offer if you still have applications outstanding with other lenders. And don’t think that just because you have poor credit now you have to feel bad or like you have somehow failed. Many people get into some type of financial troubles throughout the course of their lives and the important part is that you are finding a way to fix your credit history.