4 Student Loan Mistakes that Make Interest Rates Soar

This guest post comes from our friends over at SoFi, an innovative marketplace that connects alumni borrowers and investors for refinancing private and federal student loans.[1]

If you’ve borrowed student loans to invest in your education, you know that paying interest on those loans is simply part of the deal. But while “interest” can seem like an abstract notion when you first take out loans, over time it becomes a force to be reckoned with – particularly for the many MBA, law, and med school grads with six figures worth of education debt to repay.

For example, a borrower with $100,000 in student loan principal at a 6.8% weighted average interest rate and a 10-year term will pay about $38,000 in interest over the life of the loan. And that’s if they make every payment on time.

Paying interest on student loans may be unavoidable, but there are a few common mistakes that cause some borrowers to pay more interest than they need to. Read on to find out how to prevent these blunders from affecting your bottom line.

Mistake #1: Using forbearance when it’s not absolutely necessary

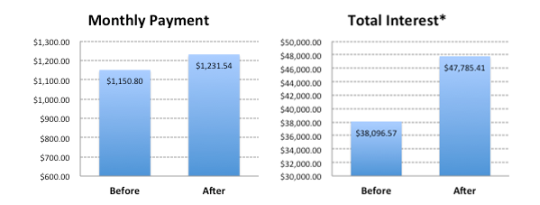

Most federal loans and some private loans will allow borrowers to use forbearance to temporarily reduce or suspend payments, but in most cases interest continues to accrue while payments are on pause – which means that the more you use it, the more interest you’re on the hook for in the long run. Here’s what happens when the borrower from our above example puts loans into forbearance for one year:

Before: $100,000 principal, 10-year term, 6.8% interest rate

After: 12-month forbearance period [2]

Bottom line: If your goal is to minimize interest, use forbearance only in cases of extreme financial hardship – and resume regular payments as quickly as possible. You can use this Forbearance calculator to do the math on your own loans.

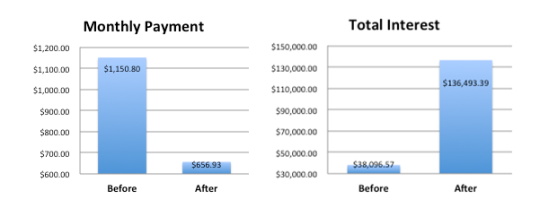

Mistake #2: Unnecessarily extending repayment period

For those with federal student loans, federal loan consolidation allows borrowers to combine two or more eligible federal loans into just one loan, streamlining your monthly bills. When you consolidate, you’re typically given the option to lower your monthly payment by extending your repayment period – which means those smaller bills can come at a big price in the form of total interest. See how extending the payment term from 10 to 30 years would make our hypothetical borrower’s interest skyrocket:

Before: $100,000 principal, 10-year term, 6.8% interest rate

After: Extended repayment period to 30 years through consolidation

Bottom line: If you want the streamlining benefits of consolidation but don’t need the drastically lower payments, you might consider trying to refinance instead (see Mistake #4 below). You can use this consolidation calculator to do the math on your own loans.

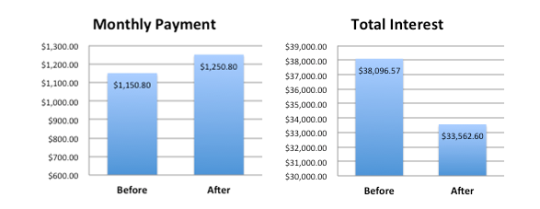

Mistake #3: Not prepaying when possible

All education loans, whether federal or private, allow for penalty-free “prepayment”, which means that you can pay more than the minimum or make extra payments without incurring a fee. Here’s how adding an extra $100 per month would affect our borrower’s bottom line:

Before: $100,000 principal, 10-year term, 6.8% interest rate

After: Prepay an additional $100 per month

Bottom line: Whether it’s increasing your monthly payments when you get a raise or putting half your bonus toward your loans each year, every little bit helps to drive down total interest. You can use this prepayment calculator to do the math on your own loans.

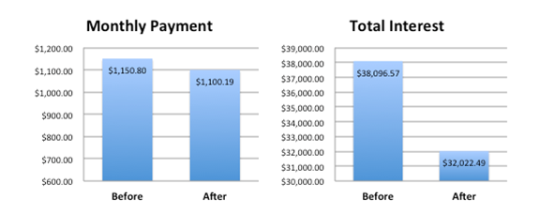

Mistake #4 Neglecting to explore refinancing options

One of the best ways to stick it to your student loan interest is to refinance your loans at a lower interest rate. This option is typically available to borrowers who have a solid financial situation – for example, a comfortable income-to-debt ratio and a good credit score. However, before refinancing federal loans, you should check to see if you qualify for any forgiveness programs (public employee and teacher are the big ones). These benefits don’t transfer to private lenders when you refinance.

Note that when our hypothetical borrower refinances (keeping the same repayment period), not only does he save on total interest, but his monthly payment goes down as well:

Before: $100,000 principal, 10-year term, 6.8% interest rate

After: Refinance at 5.8%, 10-year term

Bottom line: Refinancing can help eligible borrowers take a big bite out of total interest. Not sure if refinancing is right for you? You can get more information about refinancing here. Or check out the ReadyForZero Student Loan Resource Center. Remember, if you take the time to evaluate your options and make a thoughtful decision, you’ll arrive at the best outcome.

[1]Founded in 2011, SoFi supports 4,500 members and has funded more than $450,000,000 in loans, with an average borrower savings of $9,400. SoFi average borrower savings assumes 10-year student loan refinancing with a weighted average rate of 7.67% and a loan balance of $86,000, compared to SoFi’s median rate of 5.875% (with AutoPay).This advice is of a general nature and does not take into account your specific objectives, financial situation and needs. Before acting on this advice you should consider its appropriateness given your own circumstances.

[2]“Total interest” includes both interest accrued and unpaid during forbearance ($7,015.99) plus interest charged on the new principal amount after forbearance ends ($40,769.23). Compound interest accrued on $100K during 12-month forbearance is $7,015.99, which is capitalized, or added to the principal, at the end of the forbearance period.

I’ve had so many of my friends tell me that they paid extra on their minimum payments, and that makes me very happy. But then they go on to mention how it means they don’t have to pay their loans for another 2 months because they already paid it up front. ::face palm::