How to Pay Off Student Loans (Faster)

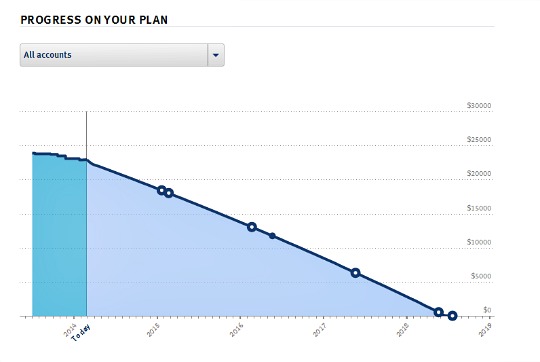

Full disclosure: Like many of our readers, I’m a student loan borrower. And even though I’m only a few years into my repayment for $23,000 of student loans – I’m already sick of it. Aside from student loan payments sucking up much of my extra income, seeing my monthly student loan bill is a constant reminder of just how much farther I have to go before I’m debt free. Seeing that far-distant debt free date is aggravating, so I think I speak for many when I say: ARRGH.

But there is a bright side to regularly checking in with my progress timeline. Monthly payments and milestones are also incredibly effective motivators. Yes – seeing the timeline of repayment can feel frustrating, but it also means that I’m motivated to boot these payments for good and I’m ready to go about it as efficiently as possible.

I want you gone, student loan debt! It’s only a matter of time…

Realizing the longevity of your debt repayment is a challenging fact to face but can also help you organize your plan of action so that you can finish paying off your student loans as quickly as possible. After all, I have other things I’d like to be paying for – travel, dance classes, my retirement. So here are the tricks and tips to focus your repayment and help rid the inbox or mailbox of loan statements as quickly as possible!

Take advantage of any interest reduction deals

When you first begin your federal student loan repayment you’ll usually be offered a few options that are incentivized by interest rate reductions. For instance, if you opt for payments to be automatically debited, then you’ll be eligible for a .25% interest rate reduction. Take it! This will directly impact how much you pay in interest. Even a small reduction will have a substantial impact on your overall plan. If the terms are feasible for your repayment plan, then take advantage of these opportunities.

On the flip side, opportunities to refinance your student loans are on the rise. While the possibility of reduced interest rates is appealing, make sure that you’re not entering into an agreement with a variable interest rate that could potentially climb above your current rate. Also to be noted – when you refinance a federal student loan with a private lender you will lose out on the attached protections (forbearance, deferment, alternate repayment plans), so really weigh the ultimate benefits of a lower interest rate versus the potential protections.

Include student loans as a part of “paying yourself”

Ever heard the phrase “pay yourself first”? That means putting money into your bills and your financial requirements right when you deposit your paycheck rather than drawing from it as the month goes on and simply estimating that you’ll have enough. Make your student loan repayment a regular part of your financial schedule and include them when you pay yourself first. This will allow you to effectively budget and readjust your repayment and also prevent you from overspending.

Allocate your payments correctly

When paying your monthly bill, make sure that your money is being applied to the right part of your payment. Some servicers default any excess payment towards future bills rather than paying down the current principal. It’s a hidden tactic that could end up costing you quite a bit. To prevent this, you will have to make sure that any extra payment is paid towards your balance rather than being pushed for future payments. When asked, choose “do not advance due date” or similar options that make it clear that you do not want your money to be applied to future payments.

Set up bi-weekly payments

Bi-weekly payments can save you an incredible amount of money over the life of your loan. It works like this: You take your monthly payment, divide it by 2, take the new number and pay every 2 weeks. Because the year is made up of 52 weeks, you’ll be paying 26 “half” payments (13 payments total) instead of paying 12 full payments in the year. This works out to an extra payment each year, which can do wonders over the life of your loan. You can even automate your bi-weekly payments in order to ensure that you never forget or miss a payment.

Quick tip: When you use bi-weekly payments, you’re essentially adding an extra payment into your yearly timeline of payments. To see the impact you can use our bi-weekly payment calculator.

Increase your payments incrementally

You’ll end up paying much more on interest payments if you stick to paying the minimums each month. That being said, upping your monthly payments by a large sum can leave you feeling stretched during the month and consequently make you feel that it’s impossible to increase your payments. So instead of immediately jumping in full force, experiment with upping your student loan payments by a small increment each month. 200 dollars more each month might sound too hard but 10 dollars might not. In this way you can find the “sweet spot” of your payments without feeling overly frustrated or stretched. To help you calculate the impact of even a few extra dollars each month, you can punch the numbers and see the impact of these measured adjustments.

What To Do If You’re Feeling Stuck

Federal forgiveness plans

If you have federal student loans, then you have the opportunity to benefit from a loan forgiveness program. Some of the most popular programs are geared towards teachers and public servants, but all require you to apply and follow the terms for the duration of the repayment plan. You’ll have to be on top of the paperwork and maintain the requirements to qualify, though the effort is worth the potential amount to be forgiven. To learn more about how to apply for the program, read our post on how to apply.

Explore alternatives when facing financial hardship

If you simply stop paying your student loans you will default and face serious penalties. If you’re facing financial hardship, you do have options and should seek all opportunities to get back on track. Remember that you can always apply for deferment or forbearance, which can give you some breathing room.

Student loan debt doesn’t just go away if you choose to stop your repayment, unfortunately. That’s why halting payments will only prolong your repayment and result in negative financial repercussions. If you’re struggling to make your payments you should talk to your loan servicer and work together to find a repayment plan that makes sense for your circumstances. For more information on default, visit the Federal Student Loan website. Beyond this resource, you can check out our student loan debt resource center for more great tips and tricks!

If you’re lucky enough to be reading this while you’re still enrolled, or even thinking about re-enrolling in grad school, here’s one last tip: start paying when you’re in school! This is beneficial in a few ways. Not only do you get a head start on paying off your loans, you also begin forming valuable habits that will make the transition to making payments after college a little bit less jarring.

Making payments while still enrolled in school is an option that’s offered most clearly with private student loans (in fact, most require that you begin your repayment while in school via interest payments or a minimum required payment) but if you have an unsubsidized federal loan then you also have the option of making interest payments while still enrolled. This isn’t the default option so you will have to opt in and contact your lender in order to begin these payments.

My wife and I have been chewing away at one of her loans. We’ve found that it helps to focus in on one loan at a time. We’ve thrown everything we can at it — most of our tax return, the money I’ve saved on our groceries from couponing, and little windfalls here and there. It works!