Exploring The Possibilities Of A Variable Personal Loan

Do you need to take out a loan for your home renovation? Or do you need extra funding for the dream home that you have been eyeing for a long time?

Whatever the purpose for the additional cash funding, there is an opportunity to realise your plans. You can approach your trusted Australian bank or other non-bank lending firms to inquire about personal loan. This is a type of loan that may or may not require collateral as security for the borrowed amount. Additionally, personal loans may be subject to a fixed rate or variable rate terms, and this will be the borrower’s decision.

What is the difference between a fixed-rate and a variable-rate personal loan?

For a Fixed Rate Personal Loan, the lender charges an interest rate that does not change for the entire duration of the loan term. This means that your repayments will be a predetermined fixed amount and will not change even if the prevailing market dictates a higher or a lower interest rate. This allows the borrower to manage his/her budget and set aside the amount for loan repayment every month. You can read more about fixed personal loan in this article.

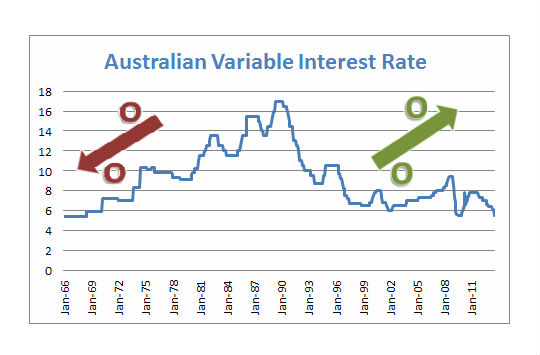

On the other hand, a Variable Personal Loan comes with interest rates that are based on the prevailing market rates. There is no one fixed rate. The repayment amount for every payment schedule may change depending on the existing general interest rates in the market.

Remember that when you avail a personal loan that has variable interest rate, there is no restriction on the purpose for which the loan will be used. This type of loan also provides added flexibility in the loan repayment terms. If for instance, your financial circumstances now allow you to cover a much higher payment, you may opt to increase your repayment amounts or make one lump sum payment at any time without additional cost. It can be paid off earlier than the scheduled loan term if your finances will allow.

Some of the benefits of Variable Personal Loans include:

Borrower can select the suitable repayment term which can range from as short as one year to a longer term of seven years, depending upon the loan purpose

Borrower can choose frequency of repayment – either every week, every other week, or every month

Borrower can access additional repayments already made

Most banks can grant a loan amount ranging from a minimum of $5,000 to a maximum of $50,000

While both fixed-rate and variable-rate personal loans can be beneficial for the borrower in different aspects, it’s important to determine your existing financial status and capability, along with your comfort level with fluctuating rates in the case of the personal loan that has variable interest rate, and your credit rating and history.